Personal Finance Software For Mac Reviews 2015

One of the more intriguing aspects of Empower’s apps is that they can be integrated with. That way, you can trade and manage your cryptocurrency portfolio right alongside your fiat currency. With solid 256-bit encryption and multifactor authentication, Empower takes serious steps to protect your financial information whilst looking to build and manage your money as best you can.

Finance Software For Mac

To really succeed though, you need to take the before anything else. Trust us on this. We tried crafting a budget without it and were a little lost: What was Age of Money? What were Immediate Obligations and True Expenses and how were they different? Why was YNAB saying we’d overspent when we still had cash? Then we took the webinar, and everything clicked. Beyond the Get Started intro, YNAB also offers live courses on Breaking the Paycheck to Paycheck Cycle, Budgeting when Money’s Tight, Paying for Big Expenses without Borrowing, and more.

If not accurate, they aren't useful. Overall, I am thrilled to have another option for Mac financial software. There is still some development to be done, but it appears that most bases are covered and quality of usefulness is high. I would recommend this product and will report back in the future.

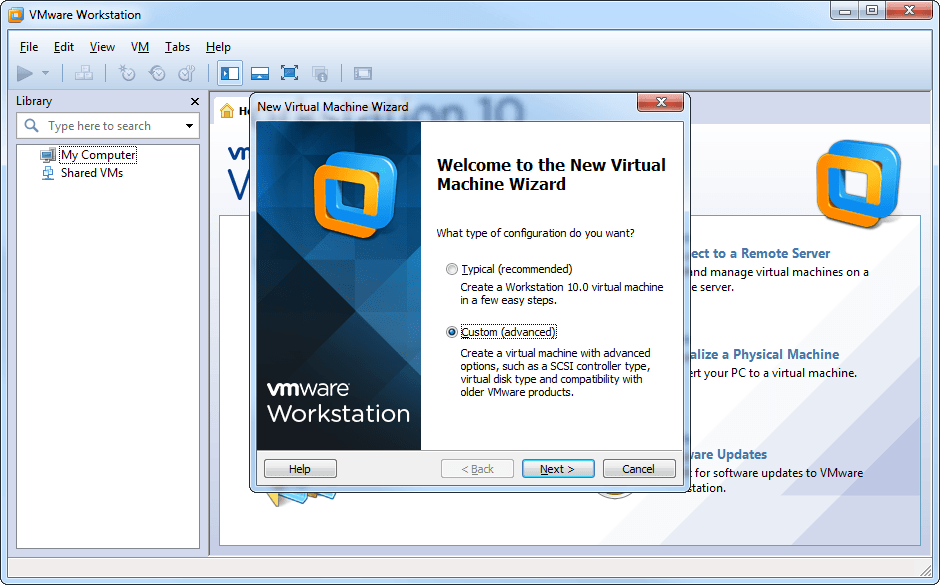

• Use Boot Camp and run vmplayer from the other OS. (Untested since I do not have a OS/X host) • Use.

That is a problem with the big 27' high resolution iMac. But, considering the solid improvements in this edition, I am willing to live with the text size issue; hoping for a later release to provide font selection and size adjustment. Even a simple change to allow a few (perhaps 3) larger sizes for text would be a tremendous help. It appears that the new Quicken owners are more concerned with product functionality and quality than Intuit has been. 11/6/16 UPDATE: The more I use this program the better I like it. I continue to be surprised by the thought that went into building this version. It is no longer a sick half-sister to Quicken Windows; it is a full-fledged money management program.

If you really want to tinker with how things work under the hood, Moneydance gives you that ability. MoneyWell, by No Thirst Software, is a unique take on the digital envelope budgeting system. The premise of MoneyWell is simple: • Fill your expense buckets when you get paid. • Assign your spending to buckets. • Stop spending when your buckets tip over. If you take the time to really figure out MoneyWell, it’s a really powerful application. It does take awhile to set it up correctly, though, and it only has minimal support for investments.

Sometimes, the dashboard is the only screen you'll need to see, because it displays the information you most need when you're checking on your financial situation. You'll learn what all of your account balances are and perhaps any bills that are pending.

Download Android SDK 24.4.1. Android app development kit. Google offers this official Android app development kit for free, it includes a series of drivers, tools and different resources needed to develop apps for the Android mobile operating system, or to run certain desktop apps. Android SDK for Mac 2018 full offline installer setup for Mac Android SDK for Mac is the official software development package for developers who want to create Android applications that can take full advantage from entire Android hardware and software ecosystem. As the Android SDK is present on all major Desktop Operating Systems (Windows, Mac and Linux), we have provided links for downloading Android SDK Tools / Command Line tools on all of these. Download SDK Tools for Windows: sdk-tools-windows-3859397.zip. Android sdk zip for mac.

But their skill at delivering the tools consumers need, and the cost at which they offer them, varies widely. Mint has won our Editors' Choice before, and it does so again this time for free personal finance services. Quicken, on the other hand, wins the Editors' Choice for paid personal finance services. We'd absolutely send people first to Mint if they're considering online personal finance because of its usability, its thorough selection of tools, and the feedback it provides users who keep up their end of the bargain by visiting it regularly.

Assuming you entered your Social Security number during setup, Mint automatically pulls your credit score and presents the number on both its dashboard and under the Credit Score link in the toolbar. You can get a little more detail about your credit score and the factors that influence it in Mint, but you don't get a full credit report. For that, you can sign up for. This free service provides your current scores and reports from two of the three agencies. Like Mint, it pays for itself by suggesting financial products that might appeal to you. No More Bill-Paying Tools Since we last reviewed Mint, the service stopped supporting its bill-paying tools. You can still schedule and track bills, though, in one of two ways.

Online shopping for Personal Finance from a great selection at Software Store. There are many websites that handle personal finance exceedingly well. We review five of the best here. Quicken, the granddaddy of all personal financial solutions, is now a hybrid solution.

We try to take this into account when picking our recommended personal finance application. • Price – While most personal finance apps are built on the same core principles, they are not all priced similarly. Some applications offer additional features, so you’ll have to weigh whether that additional functionality justifies the additional cost. Our Favorite Personal Finance App for Mac: Banktivity is the right blend of powerful features and ease-of-use to help just about anyone improve how they manage their personal finances. Importing transactions is a breeze, and it offers flexible budgeting tools to help you stay on track and make sure you meet your financial goals.